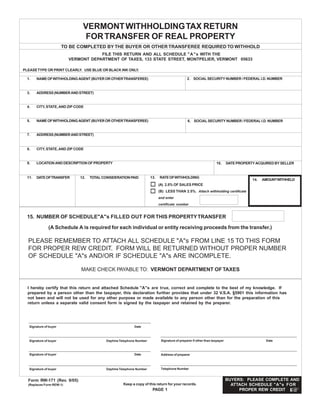

vermont department of taxes forms

IN-111 Vermont Income Tax Return. How to use sales tax exemption certificates in Arkansas.

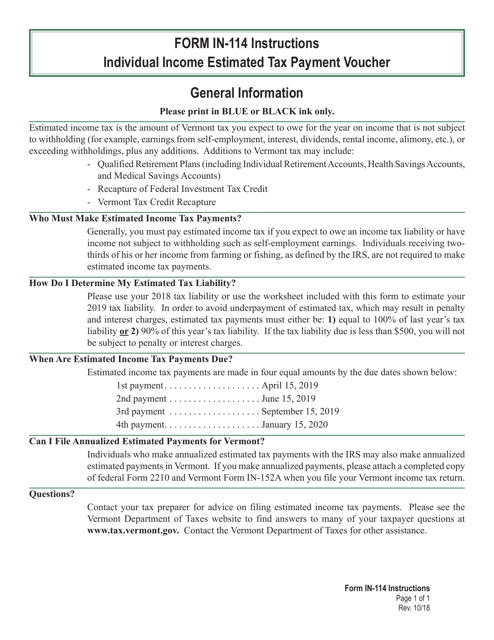

Download Instructions For Vt Form In 114 Individual Income Estimated Tax Payment Voucher Pdf Templateroller

B-2 Notice of Change.

. W-4VT Employees Withholding Allowance Certificate. IFTA and Fuel Taxes. B-2 Notice of Change.

Office of the Vermont Secretary of State. Office of Professional Regulation. Completing your required forms before arriving at the DMV will allow for a faster and smoother customer service experience.

Sign Up for myVTax. IN-111 Vermont Income Tax Return. Vermont Department of Motor Vehicles 120 State Street Montpelier VT 05603-0001.

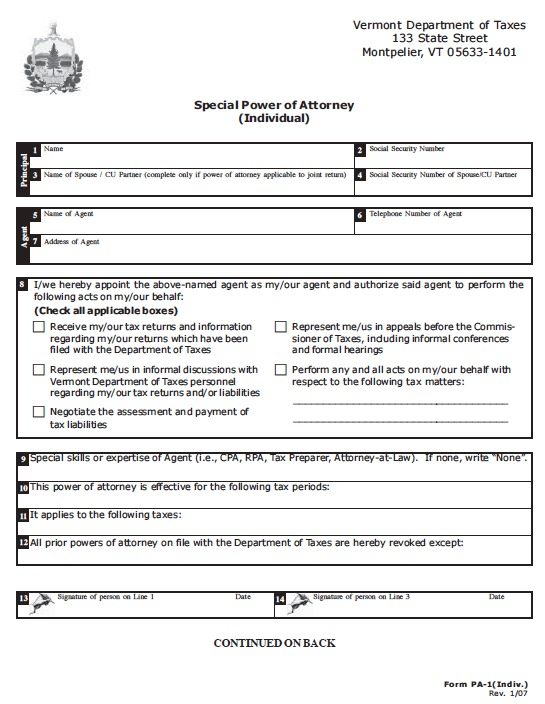

PA-1 Special Power of Attorney. Applicants must request a certificate of good standing from the Department of Taxes by sending an email with the following information to taxComplianceSupportvermontgov. There may be special forms and registration fees youll need to provide to your state motor vehicle agency.

Learn about the regulations for paying taxes and titling motor vehicles. Vermont Department of Motor Vehicles 120 State Street Montpelier VT 05603-0001. W-4VT Employees Withholding Allowance Certificate.

Report no business activity. Publications by name. Registration as a Vermont nonprofit does not confer tax-exempt status under IRS Code 501c e and f or any other federal exemption status with the Internal Revenue Service IRS.

File or amend my return. Read the 2022. 89 Main Street 3rd Floor.

Fact Sheets and Guides. The Vermont Department of Taxes publishes a report after each legislative session that outlines how legislation impacts taxpayers. Vermont Rider Education Program VREP.

Vermont School District Codes. PA-1 Special Power of Attorney. All Forms and Instructions.

Whether you want to register a car truck motorcycle ATVrecreational vehicle or trailer visit your states vehicle registration page for more information about. International Registration Plan. Please contact the IRS for information regarding tax-exemption and how a Vermont nonprofit may become tax-exempt.

You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to. Apply for a tax refund. ID SSN or FEIN.

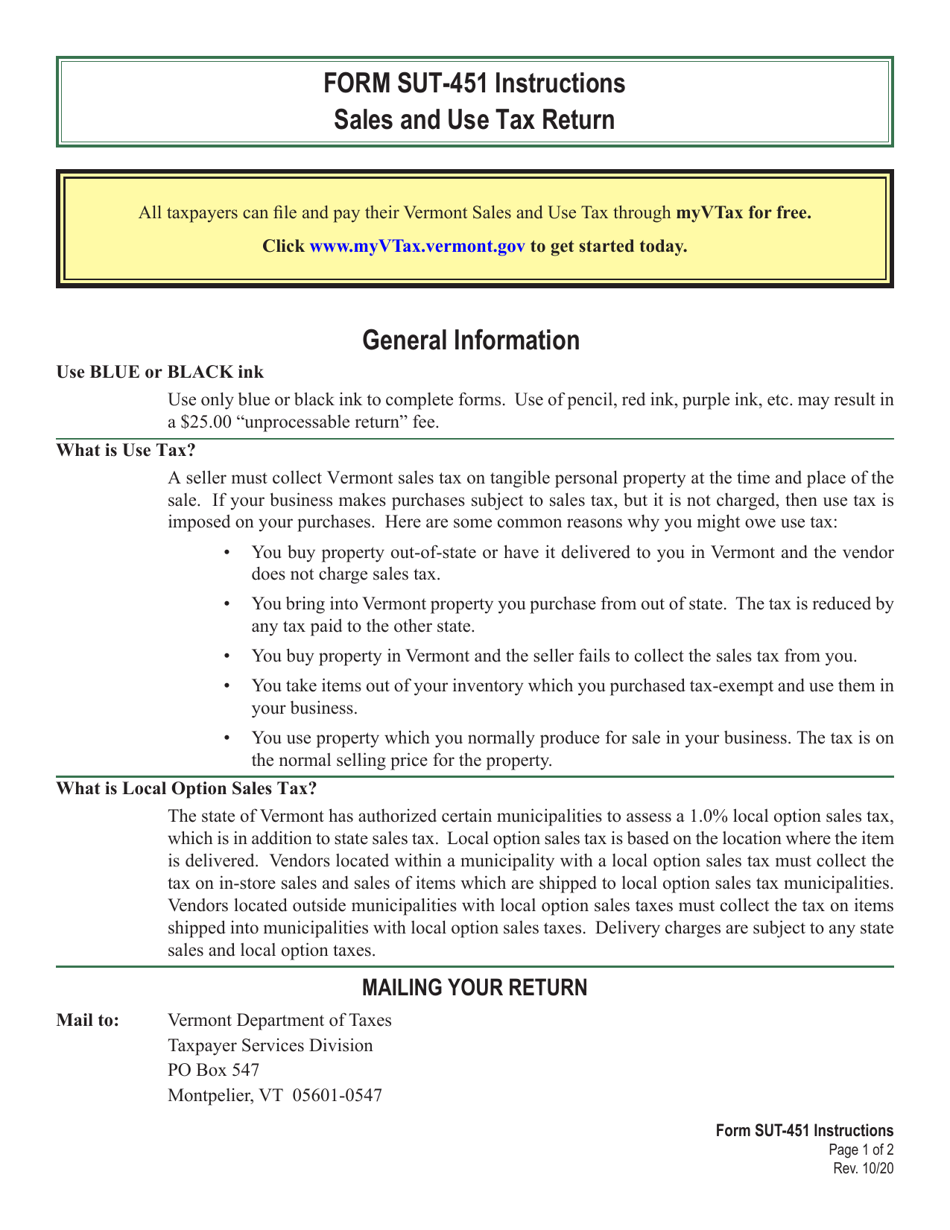

File pay taxes. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. Filing frequencies.

Vermont School District Codes.

Submit Form 15g Or 15h To Avoid Tax Deducted At Source Tax Deducted At Source Save Yourself Investing

Download Instructions For Vt Form Sut 451 Sales And Use Tax Return Pdf Templateroller

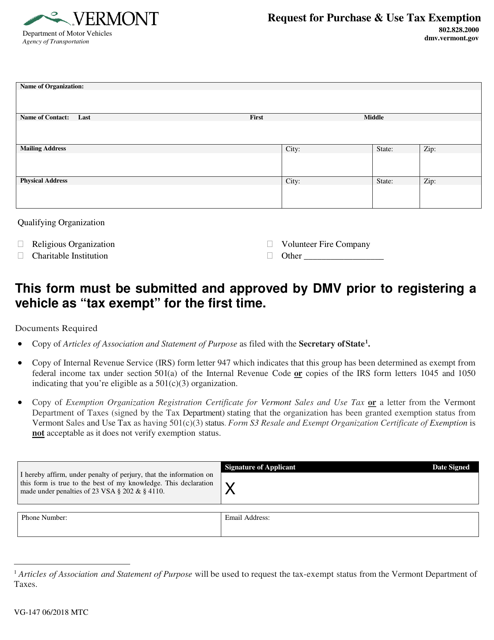

Form Vg 147 Download Fillable Pdf Or Fill Online Request For Purchase Use Tax Exemption Vermont Templateroller

Vermont Tax Forms And Instructions For 2021 Form In 111

Power Of Attorney Form Mississippi 4 Common Mistakes Everyone Makes In Power Of Attorney For Power Of Attorney Power Of Attorney Form Attorneys

Tax Year 2021 Personal Income Tax Forms Department Of Taxes

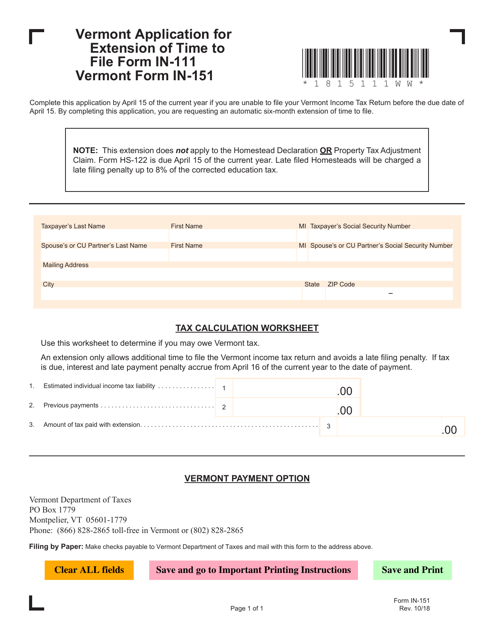

Vt Form In 151 Download Fillable Pdf Or Fill Online Application For Extension Of Time To File Form In 111 Vermont Templateroller

Publications Department Of Taxes

Power Of Attorney Form Mississippi 4 Common Mistakes Everyone Makes In Power Of Attorney For Power Of Attorney Power Of Attorney Form Attorneys

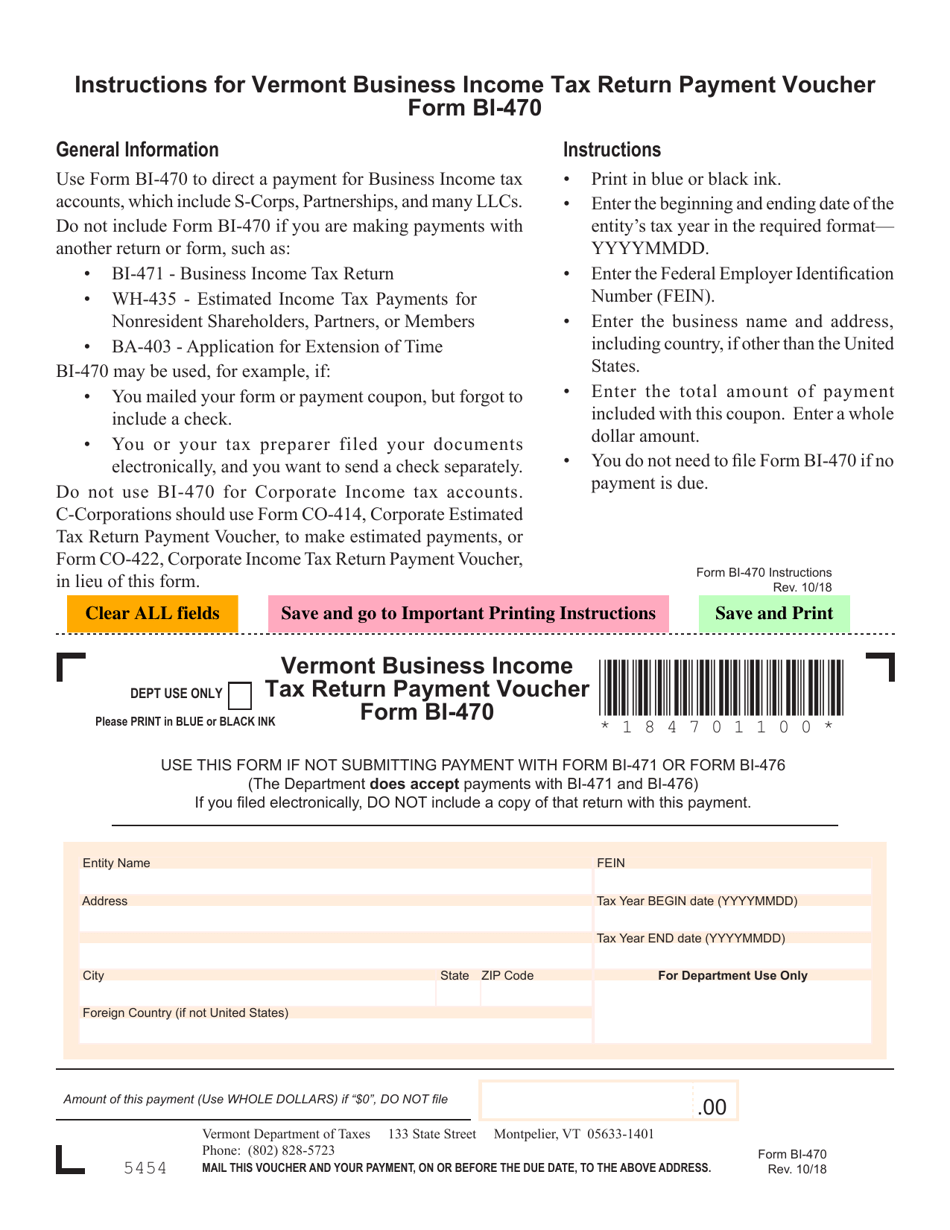

Vt Form Bi 470 Download Fillable Pdf Or Fill Online Business Income Tax Return Payment Voucher Vermont Templateroller

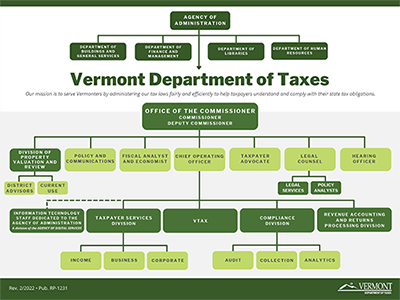

Organization Department Of Taxes

Power Of Attorney Form Mississippi 4 Common Mistakes Everyone Makes In Power Of Attorney For Power Of Attorney Power Of Attorney Form Attorneys